27 May From June Gloom to June Bloom

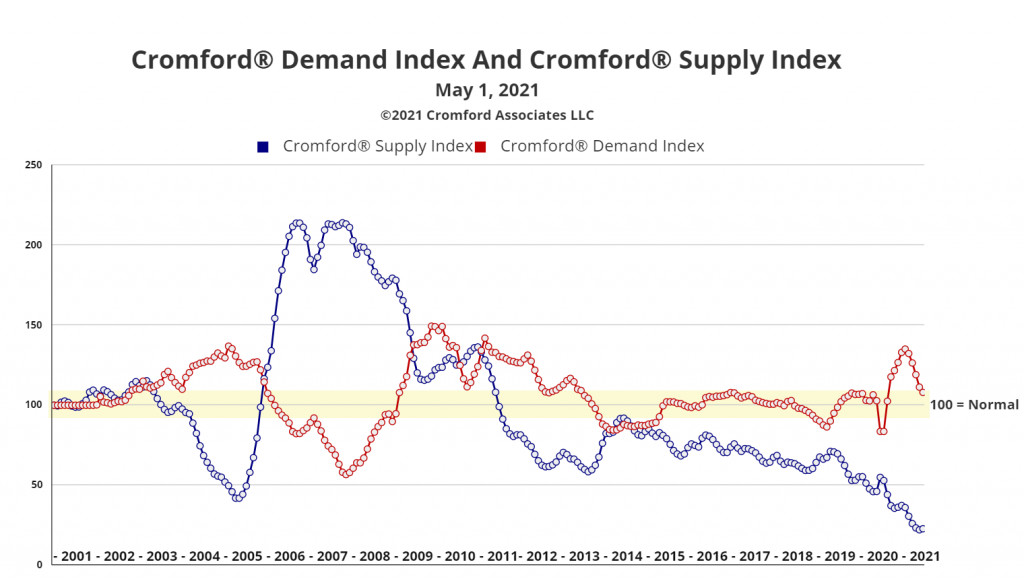

Last year, 2020 – the ultimate “June Gloom”. This year, 2021 is bringing us “June Bloom”! See the red demand line in the chart coming down? How about the blue supply line that has just begun to sideways?

Historically speaking, summer is a busy season for real estate as families prefer to move when the kids are out of school, yet 2020 was an anomaly. Covid-19 test results were peaking last summer, so most of us stayed home to self-quarantine in an effort to keep our families healthy. The real estate market dramatically changed because homeowners took down their for-sale signs because they did not want people (and germs!) entering their homes. This led to even lower supply numbers than we previously had seen.

Demand remained constant because of lower interest rates. As demand remained strong and supply fell we saw prices rise. Supply fell because of a few factors:

- Record low building across the country as home builders were still gun shy from the last boom/bust.

- Sellers are pulling homes off the market because they didn’t want to invite covid into their home.

- Sellers started to see the value of their homes go and it’s hard to sell an appreciating asset.

Multiple offers became the norm. Buyers had to come out of pocket to cover the difference between appraised values and purchase price. Let me say that in a different way. Buyers had to have more cash to buy a house than the norm because when they were under contract for $315,000 or $3,500,000 and the home would only appraise for $300,000 or $3,000,000 it meant they had to negotiate down the seller or come out of pocket to cover the price above appraised value.

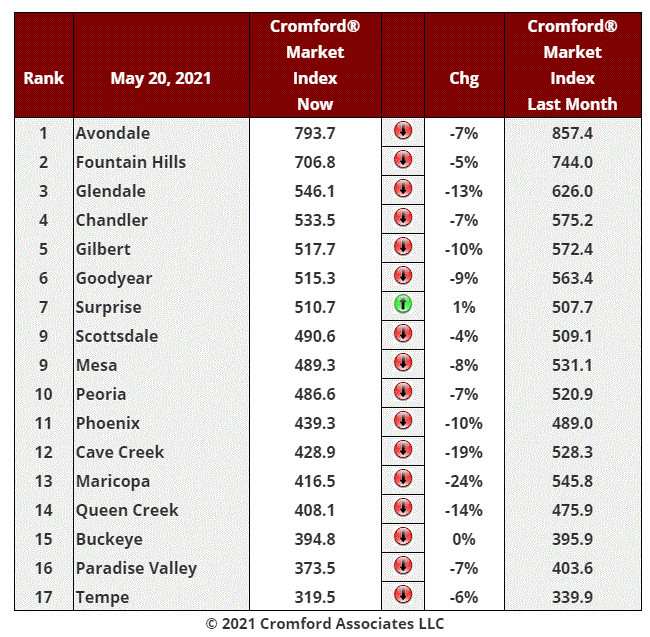

Look at these Cromford Market Index numbers – Cromford Market Index is how balanced the market is between buyers and sellers. 100 is balanced. We’ve been at record highs, but all cities except for Surprise has turned back towards balanced.

Why June Bloom?

Today, as we prepare to turn the calendar to June and summer 2021 is upon us, the real estate market is slowly turning back to normal. Mask mandates are being lifted and for sale signs are going back up – even though we’re still severely under average supply levels.

Because the higher-priced houses have closed and can now be used for appraisals, it’s easier and requires less cash to buy a house today than in February. Appraisals catching up to values means less cash needed to buy a house at the agreed-upon contract price. We actually had a contract for a buyer at $315,000 this week that appraised for $330,000!! Woo-hoo!! Instead of coming to the table with $15k cash, they came to the table with $15,000 of equity.

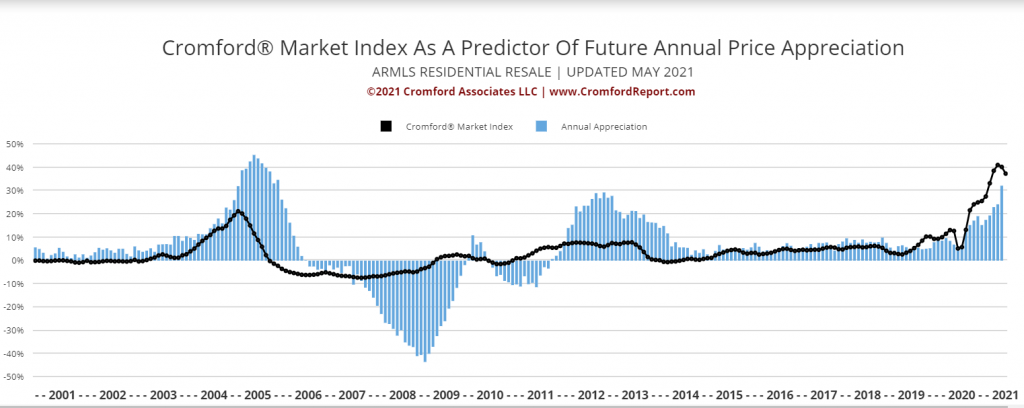

In the chart below you can see the Cromford Market Index turned 3 months ago! That’s a good thing. Another reason why I love this chart is because the CMI is overlaid on average appreciation levels. You can see the last time the CMI dipped below balanced, it took almost a year for prices to stop appreciating.

Supply has started to creep up.

Demand is starting to creep down.

We’re by no means back to a “buyer’s market” but at least we’re done going to an ultra extreme “seller’s market”.

If you are a buyer and were worn out by the craziness and cash reserve requirements, the good news is it’s getting a little easier. Yes, prices are higher than a year ago, but at least the difference in purchase price can be financed.