30 Oct What Happens to Home Prices When Interest Rates Drop?

As we navigate the ever-evolving landscape of real estate, one key factor often at the forefront of market trends is the interest rate. Understanding its impact on home prices is crucial for both buyers and sellers. The current status in the real estate market offers a compelling insight into this dynamic.

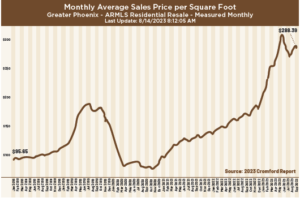

Check out this chart, it’s where prices are now… having come up from $268/sqft in Dec 2022 to $288/sqft today. And that’s with interest rates at the highest point in a long time!

Current Market Overview

Recently, home prices have shown a notable increase, jumping from $268/sqft in December 2022 to $288/sqft today. This surge has occurred amidst some of the highest interest rates seen in recent times. Despite these higher rates, which traditionally temper buyer demand, we’ve observed a relatively stable market due to a corresponding scarcity in supply. This balance has prevented drastic price fluctuations.

The Interest Rate Effect

Interest rates play a pivotal role in housing affordability and demand. A decrease in interest rates typically leads to an upswing in demand. The logic is straightforward: lower rates make borrowing cheaper, enabling more people to afford home purchases. However, there’s a catch. With demand spiking, home prices tend to rise.

When we look at historical trends, a pattern emerges. Lowered interest rates often lead to heightened demand, sparking multiple offer scenarios and, ultimately, higher home prices. It’s a classic scenario of more buyers chasing a limited number of available properties.

A Glimpse Into the Future

The scenario we’re anticipating isn’t speculative but grounded in recurrent market behaviors. Approximately 6,200 people purchased homes last month, recognizing that the market has reached a stabilization point. This decision to buy now is strategic, focusing on building equity before the next big shift.

Here’s the clincher: if, or more aptly when, interest rates lower — maybe in the next 6, 12, or 18 months — we should brace for a rapid market reaction. Prices are likely to climb sharply as the sidelined buyers leap into action, sparking bidding wars over favored properties. Remember, while you can renegotiate interest rates later, the purchase price of your home remains a constant.

For those contemplating the timing of their home purchase or sale, the message is clear: while timing the market perfectly is challenging, understanding these trends can provide a crucial advantage. Acting now might be the key to locking in a price before the next big wave of demand pushes prices up again.

Elise Fay, Realtor

Direct: 602-329-7782